[Worldline] Unlocking Commerce: The Win-Win of Dynamic Currency Conversion

By Lee Jones Chief Executive Officer — Worldline Merchant Services UK Limited.

As we navigate the complexities of global commerce, the need for efficient and transparent international transaction methods becomes increasingly apparent. One such payment option that has demonstrated its effectiveness in streamlining these transactions is Dynamic Currency Conversion (DCC). DCC is an optional service offered at the point of sale, allowing customers to view the cost of their purchases in their home currency. This facility enables merchants to offer their international consumers a simple and transparent service that suits customers’ needs, while simultaneously supplementing their margin through additional fees, without incurring any extra charges.

However, addressing concerns regarding hidden markups and unfavourable currency conversion rates is imperative. Retailers offering DCC should collaborate with trusted payment processors that provide a best-rate guarantee. Consumers, on the other hand, should compare rates at the point of sale with those provided by their card issuer to ensure they are getting a good deal.

In this article, Lee Jones, Chief Executive Officer of Worldline Merchant Services UK Limited, will delve into the benefits of DCC for both retailers and consumers, highlighting how this service can positively influence business growth and enhance customer experience.

- Benefits for Retailers:

- Revenue Growth

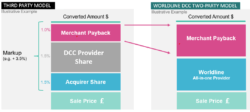

DCC introduces a profitable revenue stream for retailers. Each DCC transaction contributes to the merchant payback, as the terminal, rather than the bank, handles the currency conversion. The savings from reduced transaction fees can be reinvested into the business, promoting further growth and profitability.

Data assessment conducted by Worldline supports this potential, showing that among Tier 1 merchants—handling millions of transactions annually—approximately 1% of card-paying consumers qualify for DCC. Assuming a conservative conversion rate of 25%, with one in four of these customers accepting the DCC offer, this highlights the potential for significant financial gains.

- Implementing DCC

Unlike other financial tools that may require additional infrastructure, DCC merely requires configuration into the retailer’s existing payment infrastructure, making it a seamless addition to existing systems. This eliminates the need for costly and time-consuming infrastructure upgrades.

- Competitive Advantage

In the highly competitive retail environment of today, creating unique selling propositions and ensuring convenience for customers is vital. Offering Dynamic Currency Conversion (DCC) can be one such unique feature that sets a retailer apart from its competitors. As evidenced by the data showing U.S. tourists spending a massive USD 57 billion overseas in 2021, and 20% of online purchases by European Union (EU) customers being made outside the EU, it’s clear that many customers are conducting transactions in foreign currencies. This trend indicates an opportunity for retailers to cater to these international customers by providing convenient and customised payment options like DCC, therefore opening doors to new customers and improving sales opportunities.

Furthermore, DCC can be effortlessly implemented in an online buying environment as eDCC. It is integral for businesses to adapt to the rise of e-commerce, as it’s worth noting that global e-retail sales amounted to $4.28 trillion in 2020, and projections show a growth of up to $5.4 trillion in 2022. By providing a comprehensive omnichannel experience, retailers can tap into this expanding market, catering to international customers who prefer to shop in their home currency.

- Enhanced Customer Satisfaction

DCC allows customers to make informed decisions regarding their preferred payment currency. The terminal’s daily updated currency conversion rates ensure fair transactions for both merchants and customers. This level playing field enables customers to confidently choose their preferred payment currency while allowing merchants to offer competitive exchange rates.

- Benefits for Consumers:

- Transparency and Convenience

DCC offers transparency and convenience beyond traditional foreign currency transactions. Customers know exactly how much they will pay in their local currency at the time of purchase, eliminating hidden markups and guaranteeing the best exchange rate. This transparency removes surprises and ensures a clear understanding of all costs.

Frequent business travellers find real-time expenditure visibility particularly useful. With DCC, they can easily track and reconcile their spending without the delay associated with traditional statement delivery. It’s ability to provide clarity on both currencies and makes it easier for them to track their expenses therefore enables merchants to provide streamlined financial transactions for their customers.

Eliminating Double Conversion

In the absence of DCC, customers may face a two-step currency conversion process. For example, if a customer uses a credit card from their home country for an international purchase, the transaction could first be converted to the local currency and then back to the home currency by the issuing bank. This double conversion can result in extra fees and unfavourable exchange rates. DCC eliminates this dual conversion, ensuring customers get the fairest exchange rate at the point of purchase.

The Future of Global Commerce

DCC therefore stands as a powerful catalyst in the realm of global commerce, bridging the online and offline worlds. It’s not just a tool; it’s a game-changer for merchants seeking to bolster their revenue, streamline operations, gain a competitive edge, and enhance customer satisfaction – all without the need for heavy infrastructure modifications.

On the flip side, consumers are handed the benefit of transparency and convenience, along with the ability to track expenses in real time. This proves particularly advantageous for those who frequently traverse international borders. What’s more, DCC eliminates the risk of double conversion, ensuring customers consistently receive the fairest exchange rates.

By working with reputable payment processors and staying informed about point-of-sale rates, retailers can address any consumer apprehensions. They can offer services that are not only clear and fair but also transparent. DCC, with its capacity to revolutionise international transactions, is poised to make them more efficient and user-friendly, carving out the future shape of global retail.

Lee Jones is the Chiel Executive Officer for Worldline Merchant Services UK Limited. Prior to Worldline, Lee held a variety of leadership roles with market-leading technology companies over a 20-year period. He now leads Worldline into new markets, where the introduction of cashless payments is just starting to emerge and supporting existing customers in their ambition to meet and exceed shopper expectations.

![[Worldline] Unlocking Commerce: The Win-Win of Dynamic Currency Conversion](images/loader.gif)